Landing Gear MRO Recovery Strong, Despite Swapping and Tear-Down Options

Landing gear are major components whose overhaul is infrequent but very expensive. Like engines, gears may be swapped from grounded aircraft or replaced with used gear is some cases.

Nevertheless, major landing gear shops are seeing a strong recovery in overhauls as traffic picks up in major markets.

Christian Wicker, sales head for landing gear services at Lufthansa Technik, says business for the narrowbody Airbus A320 family, Boeing’s 737 series, A330s as well as 777s is already recovering at significant speed. LHT has had no big problem obtaining parts for overhauls, “although logistics and in particular airfreight is currently in high demand.”

And landing gear work is also changing. LHT wants to apply its digital innovations in MRO to landing gear work as well.

Although landing gear overhauls dropped during the pandemic, the drop was not as sharp as for other MRO at LHT. “Landing gears are driven by their fixed Time Between Overhaul,” Wicker notes. And LHT’s global presence has gained from early recovery in regions like domestic markets in the Americas and Asia Pacific.

“With Europe now also preparing for a busy summer, contracted capacity for overhauls in our three landing gear shops, Hamburg, London and Los Angeles, and also for the asset supply is taking off quickly again.” LHT is already turning down a number of requests for landing gear overhauls in the upcoming weeks.

Swapping gear from grounded aircraft has cut demand for overhauls a bit, but only for some aircraft types. “You have almost no chance to further extend the life of your fleet by swapping 737NG or A320 landing gears -- they all have been done,” Wicker observes.

But swapping is still common practice for legacy types such as 767s and 747s and the new A380. But Wicker cautions that swapping just postpones overhaul to later dates when gear shops will be very busy and slots will be rare.

Wicker acknowledges customers might also obtain gear from torn-down aircraft. But this option is “very much linked to aircraft type and similar to swapping gears.”

AAR’s general manager of landing gear services Scott Ingold is also seeing significant recovery in certain markets, especially for aircraft in domestic operations. “Narrowbody and regional overhauls are trending towards pre-pandemic levels.”

AAR saw a significant slowdown during the pandemic. Wheel-and-brake repairs correlated directly with how much of customers’ fleets were flying. For more expensive landing gear overhauls, customers innovated. For example by flying aircraft with the most gear green time and using much more green time than before the pandemic.

Ingold says gear swapping from grounded aircraft was much more common 9-12 months ago than now. As for obtaining gear from torn-down aircraft, “There is potential if the green time left is significant,” Ingold says. However, “any gears with less than seven years left are typically not great candidates for this activity.”

Like LHT, AAR has seen some stress in the supply chain for wheels, brakes and gear due to border controls and increased freight. “The strain on the global supply chain is causing us to increase safety stock levels to anticipate longer lead times.”

The AAR exec admits there have been workforce challenges during the pandemic. But his MRO has taken steps to keep its teams intact as the industry rebounds.

And innovation has not ceased. AAR continues to use more High Velocity Oxygen Fuel repairs and to enhance systems that give customers up-to-date status of repairs and help them evaluate schedule risks.

Pavel Hales, board chairman of Czech Airlines Technics (CSAT), predicts his landing gear overhauls will get closer to pre-COVID levels in the second half of 2021. For wheel-and-brake checks, he expects about a 30% increase, compared to the end of 2021.

Where the state of a fleet allows, Hales is seeing some swapping of gears substitute for overhaul. However, more common is postponement of landing gear overhauls. During the pandemic, “airlines using Boeing aircraft have agreed with the manufacturer to extend overhaul due dates until a downtime event.”

Replacing with used gear is often not possible as airlines that have leased aircraft are contractually bound to return the original landing gear with the aircraft. “Other customers prefer to perform overhauls as a more advantageous option to know the real state of the gear and the details about its previous maintenance,” Hales says.

Thanks to long-term planning and part inventories, CSAT has stuck to the turnaround times guaranteed to customers. “In general, Boeing is well stocked, mainly for the 737NG,” Hales notes.

And the MRO has not encountered any problems in getting wheel-and-brake parts. “Actually, the market is now overloaded with spare parts and availability is not a problem at all.”

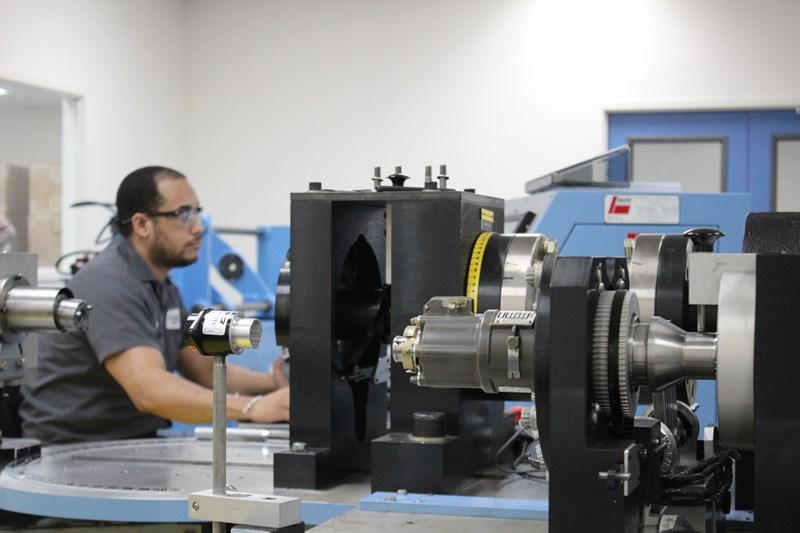

Like LHT and AAR, CSAT continued innovation during the pandemic. In 2020, a complete reconstruction of plating and painting shops was completed to meet environmental and operational needs.

A new computer numerical control milling machine was added the machine shop in 2021. “All investments will have a positive impact on the quality of performed services and the capacity of the landing gear division,” Hales says.