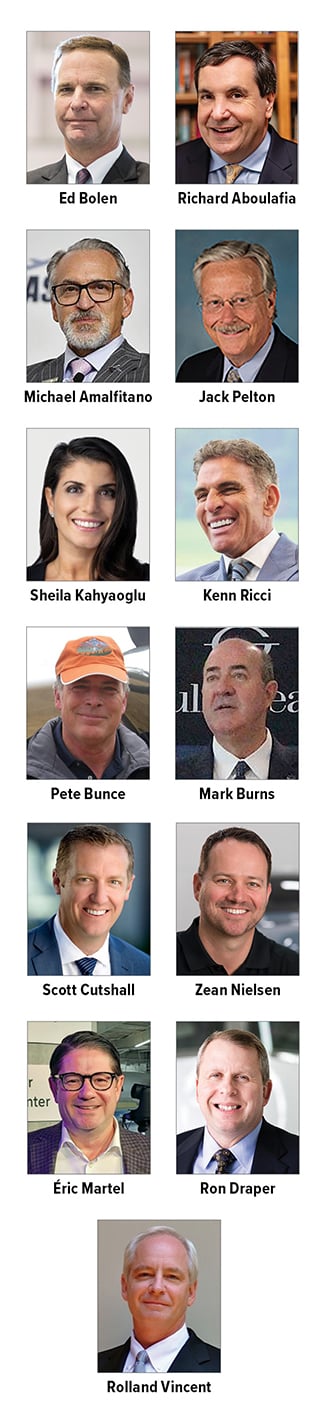

With the start of a new year, we’ve asked business aviation industry leaders from a variety of segments to share their insights and predictions for 2025. They weigh in on what they predict will be the biggest business aviation story during 2025, what they foresee as the biggest challenges and what they project will be the biggest achievements or advancements during the year.

What do you predict will be the most significant story of 2025 as it relates to your segment of the business aviation industry?

Ed Bolen, National Business Aviation Association president and CEO:

I think how we continue our momentum on sustainable aviation fuel will be key. I feel like we’ve come a long way in a short amount of time. We’ve seen investment coming into the industry. We’ve seen production facilities beginning. We’ve seen farm groups that are really getting behind this. I think this will be a key year as we have the blenders’ tax credit moving into 45Z. All of those things, I think, could be really impactful on the momentum that we’ve gained to date and our commitment to being net-zero carbon emissions by 2050.

Richard Aboulafia, AeroDynamic Advisory managing director:

A global political shift that favors business aircraft. The business jet community has become inured to regular beatings from the pro-environment crowd and from progressive politicians. But in many countries—particularly the U.S. but other countries, too—there was a notable shift this year towards more pro-business governments that don’t care about the environment and are just fine with private aviation. Some of the heat the industry has felt may be diminishing, even in Europe.

Michael Amalfitano, Embraer Executive Jets president and CEO:

Over the past few years, our industry has witnessed an extraordinary surge in demand, stretching new production delivery times out to unprecedented levels. While this huge surge has bolstered backlog, it has placed immense pressure on the entire supply chain value stream, tested customer patience and left many stakeholders wondering: When will market demand slow down? But instead, in 2024 we experienced the stabilization of that demand growth, cementing a new normal. 2025 may emerge as an even more pivotal year, where the industry achieves the true demand-supply balance it has long sought—reducing delivery times, improving customer experience, while continuing investment in the advancement of technological innovations and the pursuit of future environmental goals. Embraer is at the forefront of these bold efforts, driving innovative growth and pioneering sustainable practices that set a new standard for the industry.

Jack Pelton, Experimental Aircraft Association chair and CEO:

For business aviation, it will be about the economy and policy that supports business aviation growth. Accelerated depreciation along with strong business growth could lead to the precursor of the next start of a growth trend that could last for a number of years. As for general aviation, the most significant story will be the implementation of the MOSAIC [Modernization of Special Airworthiness Certification], which expands the definition of light sport aircraft. This will lead to significant growth in general aviation from flight training to new products, to new technologies and new life, [and] to existing aircraft that will now be eligible to operate as light sport aircraft.

Sheila Kahyaoglu, Jefferies managing director, equity research:

The most significant story of 2025 will likely be related to the regulatory environment in business aviation given there are a set of new jets set to enter service including the G800, G400, Citation Ascend, Citation Denali and Global 8000. The G700 has struggled [in 2024] and it has had an impact on General Dynamic’s share price. Three of those aircraft are clean sheets, while the Ascend and Global 8000 are derivatives that should be easier to approve. However, we have seen increased regulatory scrutiny across the group since the [Boeing] MAX grounding and the G700 has had a slow start to deliveries in part due to the need to certify each new cabin configuration. Any change to the FAA process in the new administration may be impactful as well, either positively or negatively, as it relates to certifying these new aircraft and allowing for a relatively quick ramp following entry into service.

What do you predict will be the biggest challenge or concern for your segment of the industry in 2025?

Kenn Ricci, Directional Aviation Capital principal and Flexjet chair:

[The market] has been so strong for so long. This too shall pass; I’m not going to predict the downside, but I think you have to be paranoid. I think you should be cautious. I don’t think it’s the time to outspend your coverage. We’ve had great years. We’ve had four or five great years. It’s time to just hoard a little bit and see what comes. I’m not a stock market prognosticator, but people have this huge, lofty opinion now because of the Trump surprise and what they think can come politically. [But] every problem in the world is not going to be solved. And when that comes to light, every financial optimism is not going to be there. I just think you have to be thoughtful and cautious about it. But that’s part of being a good businessperson.

Pete Bunce, General Aviation Manufacturers Association president and CEO:

With new sessions and assemblies of governments convening in both the U.S. and Europe, as well as a new administration and commission on respective sides of the Atlantic, it will be important that our industry works together to make the case to government leaders about the essential nature of the general and business aviation industry. It is critical that leaders understand that our industry is the incubator for safety, technology and sustainability, and stands ready and willing to work together on constructive policies to support the continued growth and societal health of countries and communities globally through business and general aviation products and operations.

Mark Burns, Gulfstream Aerospace Corp. president:

I see a great deal of opportunity for the business aviation industry to make more strides toward carbon neutrality. For Gulfstream in particular, our work on the R&D side of sustainability will continue. We have been leading the charge in research around 100% neat sustainable aviation fuel, and I am excited to see the advancements our team will build on that in the year ahead.

Scott Cutshall, Clay Lacy president, real estate and sustainability:

Avoidance of a significant downturn in the economy and markets.

What do you predict will be one of the biggest achievements or advancements in 2025?

Zean Nielsen, Cirrus CEO:

I think Simplified Vehicle Operation (SVO) type features will continue to appear in more and more places and on more and more platforms. Making it easier and safer to fly smaller aircraft will be key to continued growth of the general aviation space. Smaller general aviation airplanes (usually below $7 million) are flown by the owner who is inherently a “part-time pilot” versus a professional pilot. Bigger airplanes often have two professional pilots, and that market isn’t in my opinion where the action is. We need to bring thousands of people into general aviation and we are most likely to succeed in that at the entry/lower level. To do that, we need to make it easier to fly, and SVO can aid in that. And we have to build experiences that mimic owning and operating a car—something we all have done before.

Éric Martel, Bombardier president and CEO:

The arrival of the Bombardier Global 8000 in 2025. The entry into service of this jet goes beyond the first deliveries—it also signals the start of a broader change. Our entire fleet of Global 7500 aircraft will become eligible for a performance upgrade that will effectively transform them into Global 8000s. Given that we recently celebrated the delivery of our 200th Global 7500 aircraft, this is a significant opportunity for our Global 7500 customers to take their jets to the next level. The Bombardier team is very proud to keep innovating and pushing the boundaries of what a business jet can do.

Ron Draper, Textron Aviation president and CEO:

I’m impressed to see the rapid integration of new technology into general and business aviation aircraft. When you consider how quickly our sector is incorporating innovations in avionics, autonomy and electrification, for example, you must be impressed at the explosion of technology that propels major flight advancements. Being a driving force for technological enhancements makes this business an exciting place to work and grow a career.

Rolland Vincent, Rolland Vincent & Associates founder and president:

In 2025, I believe that we could witness some major announcements on the new product development front, including new engines and one or perhaps two new aircraft models that will capture the attention—and share of wallet—of customers eagerly awaiting next-generation designs.