Fleet growth at China’s three largest carriers and some startup airlines is expected to drive MRO spending.

China’s zero-COVID-19 policies hit domestic and global supply chains of many industries—aviation chief among them—during the height of the pandemic. Extended lockdowns in major passenger hubs such as Beijing, Shanghai and Guangzhou frustrated China’s domestic ambitions and contributed to a further slowdown in the global aftermarket’s recovery. China’s reopening this year largely has been welcomed by global businesses still suffering from the lingering effects of its sluggish economic recovery.

Over the past 30 years, the country has been embraced by Western MROs as a base for joint ventures, serving not just the large China market—valued at $126.9 billion over the next 10 years by the Aviation Week Network’s Fleet & MRO Forecast—but also the wider Asia-Pacific region. Lufthansa Technik Shenzhen, MTU Maintenance Zhuhai, HAECO and Ameco Beijing are some of the Chinese-Western partnerships catering to these markets.

Further joint ventures are expected in China, such as the Beijing-based engine shop Rolls-Royce and Air China plan to open in 2025 to serve Trent engine repairs. Kin Chong, executive vice president of Taiwan-based Evergreen Aviation Technologies (EGAT), sees room for more joint venture opportunities in areas such as component MRO, particularly as the Chinese government retains ambitions to build an entire aviation ecosystem with full domestic capability.

“The component segment has the highest percentage of work shipped outside of China and, given the strategic development undertaken by the government, that’s probably what they are looking at for more joint venture opportunities in China,” he said during a panel at MRO Americas in Atlanta in April.

However, the effects of COVID-19 on the Chinese-Western relationship are likely to bring a permanent shift in areas such as the aviation supply chain. “It’s a wake-up call to many of the suppliers to realize that there are alternatives, because China isn’t necessarily the low-cost manufacturing base that it used to be,” Chong says. “COVID also amplified a lot of the policies in China and how they ensure that these policies are really only to their benefit and not necessarily taking into consideration other interests as well.”

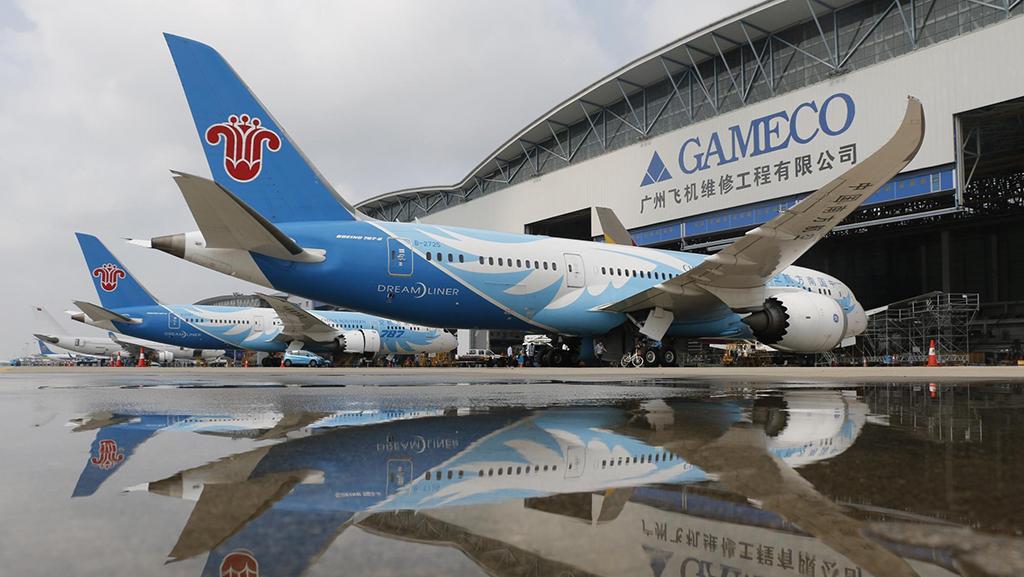

Marc Szepan, general manager of Chinese MRO Guangzhou Aircraft Maintenance Engineering Company (Gameco), says that given the general levels of innovation taking place across the industry, the intention is to shift supply chains more globally. Whether this happens, and to what extent, remains unclear. Szepan says it is hard to replicate the supplier ecosystems in low-cost labor markets of the Asia-Pacific region outside of China, which is no longer selling products and services based on price.

“From a manufacturing point of view, for a number of years, it hasn’t been about cost but instead about the efficiency of the manufacturing ecosystem in many parts of China,” he says. Szepan notes that China has some way to go in supplying components such as high-pressure turbine blades, composites and avionics parts but is strong in other areas. “If you look at structural and cabin components, the early days of when Boeing or Airbus had to rework what they received from Chinese suppliers have been gone for about 20 years,” he says.

Having endured a series of economic hits in the 3.5 years since the outbreak of COVID-19 in Wuhan, Szepan says Beijing is now trying to incentivize doing business in the country and appease companies looking to shift away from China as a sole supplier. “The government has really upped their game in terms of giving a financial ecosystem and technological access incentives, so it’s not trivial to balance out these different objectives,” he says.

Jason Dickstein, general counsel for the U.S.-based Aviation Suppliers Association, says China’s aviation sector has experienced a dramatic change over the past 30 years. During this period, he notes that it has evolved from a low-cost and low-quality source to one offering higher-quality products and services with wage increases to match. “As a consequence, China could potentially be a very important long-term partner for the aviation world because their quality standards are going up and they are meeting the expectations of the aerospace community,” he says.

The 25% tariff the U.S. placed on Chinese aerospace goods will impede American participation in the Chinese supply chain, Dickstein says. “But for other countries that don’t have that sort of tariff, there’s much more of an opportunity to rely on the increasing quality standards of China for them to continue to be an important part of the supply chain,” he says.

Western concerns about intellectual property in China persist. “China has changed its intellectual properties on the books so that they match Western ideas of patent, trademark, copyright and trade secret protection. But while they’ve changed the laws on the books, it takes a while to change the hearts and minds of people who have traditionally thought whoever can make the best use of the idea should do so,” Dickstein says.

In China, Gameco has a vested interest in Chinese-U.S. relations because, in addition to its aircraft maintenance, component repair and painting services, it also operates passenger--to-freighter conversion lines for Boeing in Guangzhou, including two lines for the Boeing 767-300BCF and three conversion lines for the Boeing 737-800BCF.

Szepan says that despite Chinese-U.S. geopolitical tensions, companies appear determined to have the right type of projects in China and show commitment to the market. But one area that could be affected is China’s foray into airframe manufacturing through the Comac C919 aircraft program. The narrowbody entered service in late 2022 powered by CFM International Leap 1C engines and includes some components made in the U.S. Dickstein says Chinese airlines will buy aircraft made in China without pressure from the government.

“China is an intensely patriotic country, and I think that opportunity to buy Chinese aircraft means they don’t have to be forced to buy them,” he says. Any concerns about performance gaps between the C919 and its Western-made rivals, the Airbus A320neo and Boeing 737 MAX, will also be short-lived, Dickstein predicts.

“China does things in two iterations: They’ll turn out a product and it is invariably declared as inferior, but the second iteration of that product will be superior, as they are very good at fixing their problems and investing to make it better,” Dickstein says.

EGAT’s Chong agrees that the program will be enhanced by further iterations. “[China] will be relentless in their pursuit to excel in what they feel is important to them,” he notes, adding that in addition to airlines, Chinese-owned lessors also will likely place orders for the C919.