Over the past few decades, engine manufacturers have tended to steer customers toward full-service maintenance programs, under which airlines pay for support based on their engines’ flight time.

Often, this was a win-win situation, providing risk transfer and predictable costs for airlines and locking in long-term revenue streams for the OEMs.

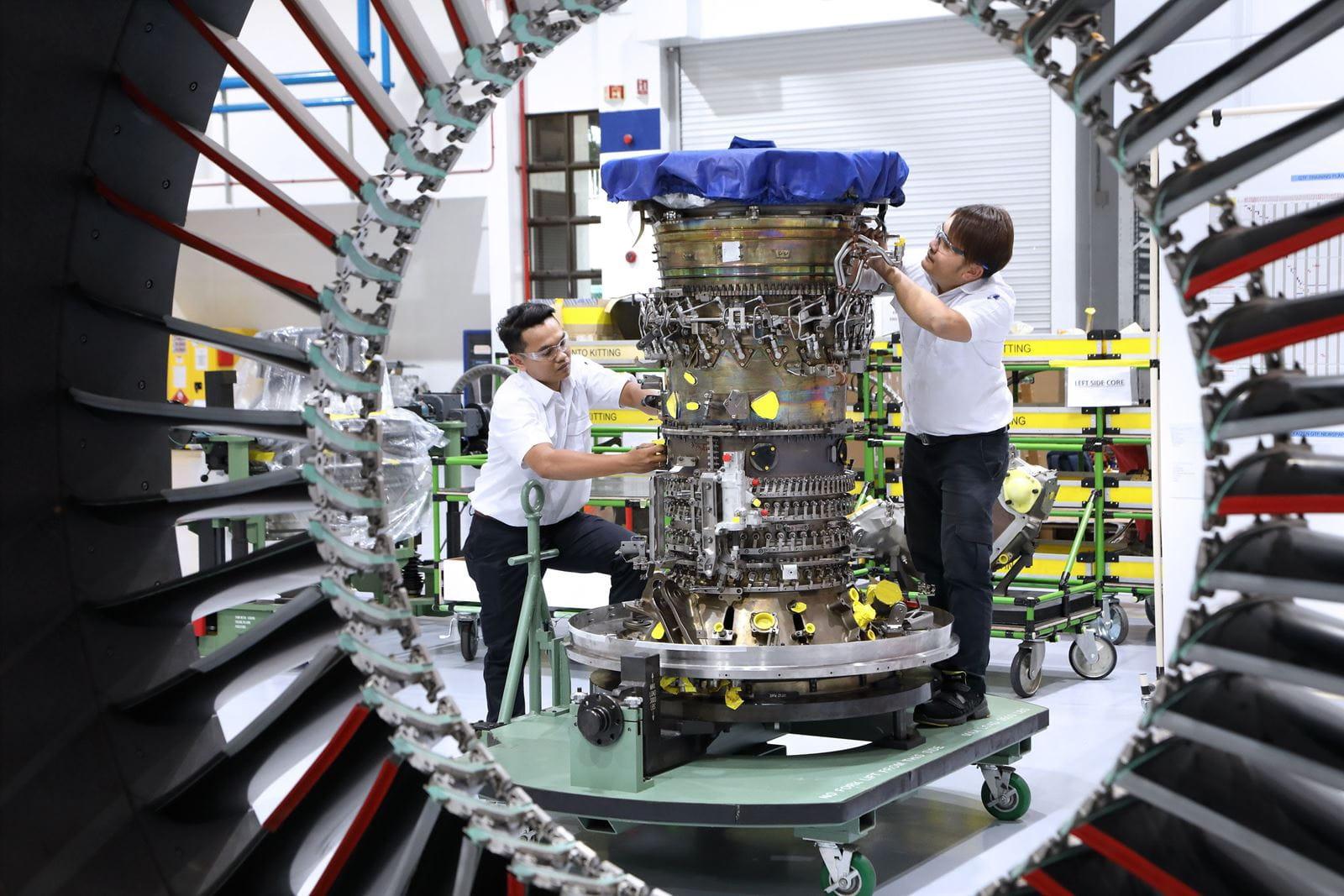

Manufacturers also benefited from the exceptional reliability and durability of engines like the CFM International CFM56 and IAE V2500, which stretched out the time between overhauls, limited hospital visits and unscheduled maintenance.

However, these attributes are not shared by newer engines like the CFM International Leap and Pratt & Whitney Geared Turbofan, as a result of which certain OEMs are cooling on full-service, flight-hour-based maintenance contracts, according to lessor Avolon.

It noted that engine-driven aircraft groundings peaked in 2024 as Pratt & Whitney continued to rectify its powdered metal production quality issues, while Leap groundings also increased due to the need for high-pressure turbine blade replacements.

“New-technology engine durability issues have resulted in some manufacturers decreasing their focus on risk transfer maintenance programs, driving cost increases for airlines that risk outweighing fuel savings,” the lessor wrote in its 2025 business forecast. “This trend reinforces the value of current-technology models while fuel price remains moderate."

Avolon also noted that the average age of passenger aircraft has risen 1.7 years since 2018 as airlines are forced to operated older aircraft for longer than usual as a result of new generation engine issues due to a “structural under-supply of new aircraft.”

It added: “Longer economic lives support demand for maintenance services and strong aircraft residual values.”