Despite a near-term dialing back of capacity amid rising fuel prices, American Airlines believes demand will come back strongly as the year moves forward, leading to a “bullish” long-term forecast.

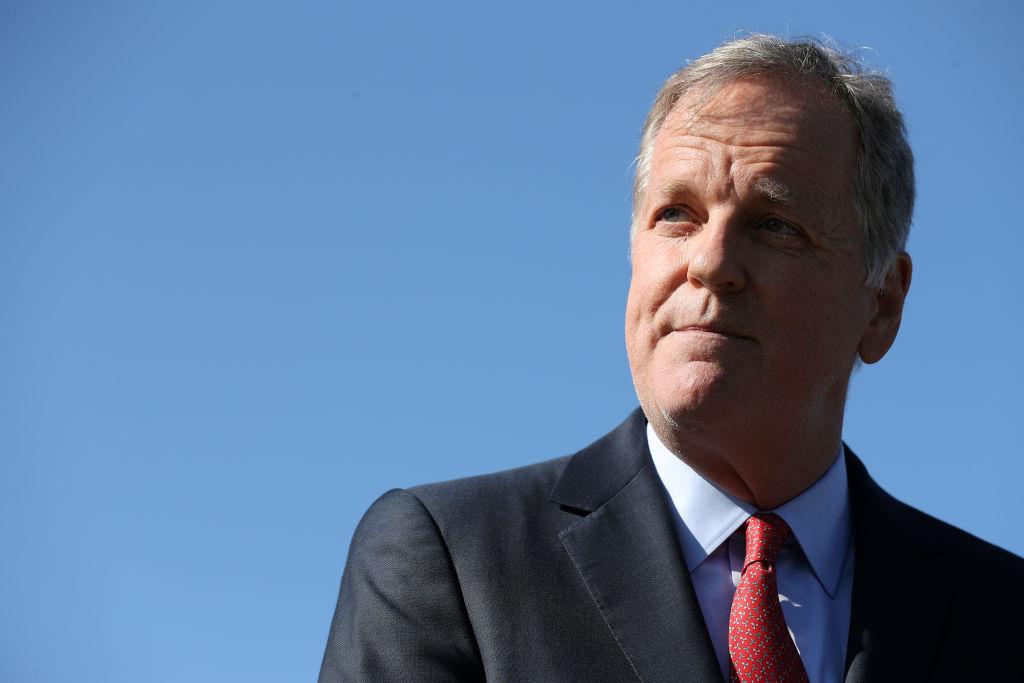

Speaking March 15 at a J.P. Morgan investors’ conference, outgoing American CEO Doug Parker said the “cataclysmic shock” of the COVID-19 pandemic will give way to a resumption of the high-growth air traffic trends seen in 2019 and preceding years. The CEO will be stepping down from his post at the end of March.

“I believe that right now is a really great time for people to be buying airlines’ [stocks],” Parker said. “In total the industry is so undervalued … I’m really bullish on this business.”

Nevertheless, American said March 15 that it is lowering first-quarter capacity guidance down 10%-12% versus 2019. Previously, the Dallas/Fort Worth (DFW)-based carrier said March-quarter capacity would be down 8%-10% compared to 2019.

Parker said pent-up demand is being “artificially restrained” by lingering COVID-19 restrictions. “There’s a huge amount of growth here,” he said. “As constraints have fallen [in various travel segments], demand has come back just fine. There are [now] no constraints on domestic leisure and demand [in that segment] is higher than it’s ever been … The bookings right now are incredibly strong. Demand for [leisure] travel is very strong.”

Parker conceded business travel and long-haul international flying are taking more time to bounce back. “Business [traffic] of course hasn’t come back as fast,” he said. “The constraint for business travel isn’t fear of COVID; it’s people not being in the office … Business travel is coming back and it’s coming back as people are returning to the office and getting back on the road … It is absolutely, positively starting to come back.”

Parker added that “there is huge pent-up demand for international travel.” He conceded international long-haul flying will not be back to 2019 levels by this summer, but he believes long-haul demand could return to 2019 levels by the end of the year “as markets open up.”

Parker cited two factors constraining short-term demand that are not tied to the pandemic or rising fuel prices: delayed aircraft deliveries—because of both safety and supply-chain issues—and a growing pilot shortage in the US.

“We have 14 fewer [Boeing] 787s than we want to be flying.” Parker said. “We’re not happy about that.”

He added: “There is a shortage of pilots at [US] regional airlines. We are depleting the [pilot] ranks of the regionals faster than they can fill them.”

This is leading to less service to smaller communities, he said. Parker noted that American is having no trouble filling mainline pilot positions, but many of those hires are coming from regional airlines struggling to find new flight-deck crew.