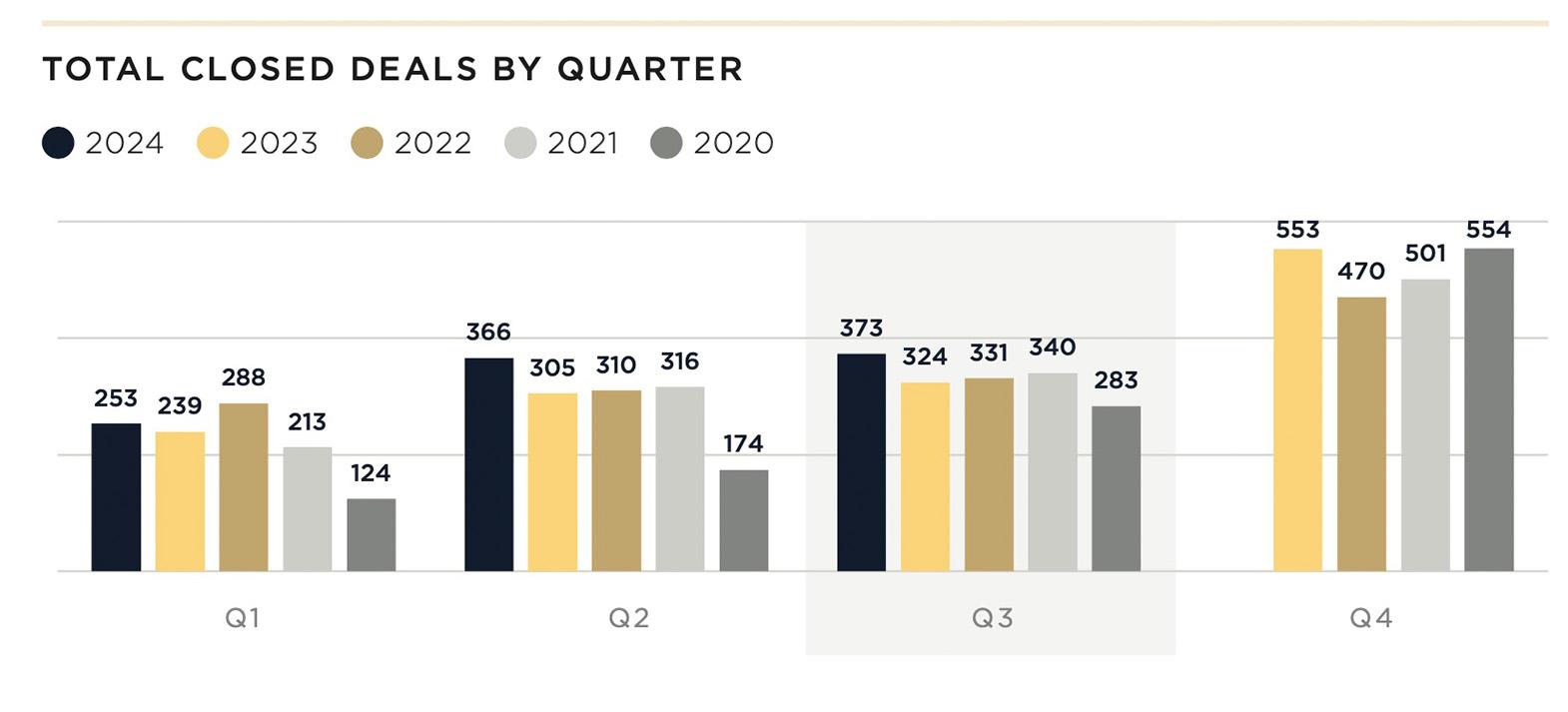

Pre-owned aircraft closed transactions by quarter.

Aircraft dealers closed 373 transactions for pre-owned models in the third quarter, a 15% year-over-year increase and the highest level of third-quarter closings recorded by the International Aircraft Dealers Association (IADA) since it started surveying members in 2020.

Releasing its third-quarter market report on Oct. 21, IADA said its members closed 993 transactions through September, 14% more volume compared to the first three quarters of 2023.

The inventory of pre-owned aircraft has grown over the last year, softening demand and lowering prices. Buyers have gained negotiating leverage when considering older models, IADA says, but newer pre-owned models remain in demand.

“There is movement, and it is becoming more of a buyers’ market than a sellers’ market, but it’s a very normal progression,” says IADA Executive Director Wayne Starling. “It’s largely because inventory is increasing. But if you look for a late-model [aircraft], the inventory has not increased there. It has increased for some of the legacy, older aircraft that people are putting on the market. Those aren’t moving like they were two years ago.”

Dealers reported 144 new acquisition agreements in the third quarter, a 4% increase over the second quarter and 22% more year-over-year. The number of exclusive retainer agreements stayed steady from the previous quarter. There was a 67% increase in reduced-price listings year-over-year measured from a relatively small base, IADA reports.

“As expected, price adjustments are a feature of today’s market as the resetting of value expectations continues after post-pandemic highs experienced in 2021 and 2022,” the association says.

IADA has announced that 87 of its dealers, OEM members and products and services companies will attend NBAA-BACE this year. The association’s 65 accredited dealer companies and brokers collectively account for 50% of pre-owned jet and turboprop transactions worldwide, IADA says.

During a meeting with Business & Commercial Aviation, Starling and IADA Managing Director Erika Ingle outlined ways the association helps its members move pre-owned aircraft from listing to sale.

IADA’s AircraftExchange.com web portal consistently lists 800 pre-owned jet and turboprop aircraft being offered, as well as helicopters and piston airplanes. The website averages 67,000 unique visits monthly and has 25,000 subscribers who can track specific models and receive notifications on new listings or price changes.

Behind the public-facing portal, member dealers and brokers can see up to 10 days in advance which aircraft are coming on the market and can list models their clients are seeking on an exclusive broker portal. More than 500 brokers “are constantly looking at that,” Starling says.

“It has really become what I consider the ‘billboard’ for IADA because it’s a way that the public gets one of the benefits of what we do and it’s set up a communications vehicle for our dealers,” Starling says of the Aircraft Exchange. “During the COVID era, over 75% of all the transactions we did never made it to the public website; it was all done behind the scenes.”

IADA anticipates stable demand for pre-owned aircraft generally over the next six months, marked by favorable conditions for both buyers and sellers. The result of the U.S. presidential election in November is not expected to play a role this year. Reserving pre-buy inspection slots at busy MROs, however, could be a challenge to closing transactions.

“It appears we’re in line for a very strong fourth quarter,” Starling says. “Our members across the board really don’t feel [the election] is going to have an impact this year. One of the concerns we have going into the fourth quarter is having pre-buy slots available.”

The absence of some aircraft manufacturers at NBAA-BACE—Dassault and Gulfstream are not exhibiting this year—limits the portfolio of aircraft that potential buyers can peruse, Starling says.

“I think it does have some negative effect on the overall event because NBAA is looked at as the place where once per year you can come and see every manufacturer’s new products—they always have the latest and the greatest as well as their entire line there,” he says. “We work closely with NBAA, and they’re working hard to try and make sure that we get the attendance up from potential owners and pilots. That’s really what the convention is about, to show the world what [business aviation] is doing.”