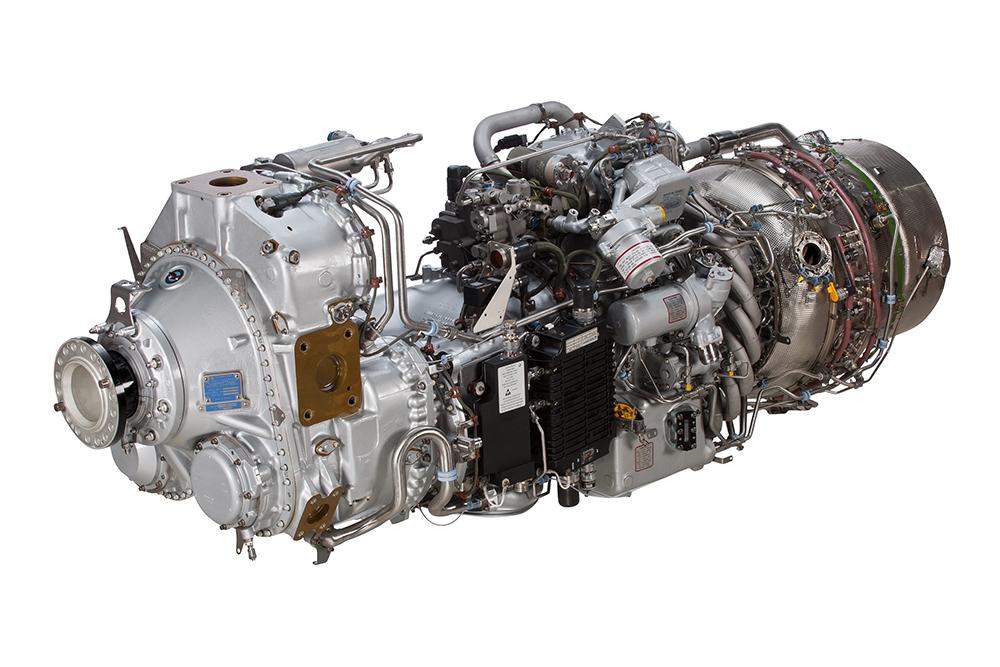

Regional aircraft lessor ACIA Aero plans to beef up spare engine availability for the Pratt & Whitney Canada PW127M platform as operators continue to face uncertainties in the supply chain.

ACIA has purchased 10 new PW127M engines to support its fleet of leased ATR aircraft, with deliveries expected over the next 24 months, according to Neil Du Preez, senior vice president of technical and asset management at ACIA Aero Leasing.

Given the global parts shortage and the widely held view that this challenge will remain for at least another 18-24 months, Du Preez felt it was essential to assist ACIA’s lessee base with spare engine capacity that will allow them to continue with efficient operations.

Engine MRO backlogs are still lingering in the hundreds, with lead times spanning to at least six months for a full engine shop visit. “Our investment in these 10 new engines will help us alleviate this challenge for our customers,” adds Du Preez.

Du Preez sees plenty of inquiries around these engines from third parties for sale or lease opportunities, reflecting significant market demand. However, this is currently not part of the core business at ACIA Aero Leasing.

“Whilst we would always look at new business streams that benefit the ACIA Group, we are entirely focused on using these engines to service our own owned assets,” says Du Preez.

In terms of aftermarket support and broader technical service for operators of such engines, Du Preez highlights the activities at the sister company ACIA Aero Parts, which offers ATR part supplies that may be surplus to ACIA’s own requirements. “We also offer STC [supplemental type certificate] solutions, such as our ownership of the LCD [Large Cargo Door] solution through our sister company IPR Conversions,” he says.

ACIA Aero recently attended ATR’s operators conference in Toulouse, where some early signs of recovery in the troubled supply chain were noted. However, Du Preez thinks there is still a ways to go.

“For now, it is difficult to see any light at the end of the tunnel and consensus amongst most stakeholders, including, of course, the airline base,” he says, noting that the earliest he expects the situation to return to normal is late 2026.

These challenges are not specific to engines but apply across all main components, such as propeller hubs, landing gear parts and other parts on the “red list” as Du Preez describes. “It’s not uncommon to struggle finding the most basic parts, whereas pre-pandemic, it wouldn’t be an issue,” he says.

Tighter connections with aftermarket suppliers and MROs in support of those engines is also critical, with Du Preez noting that ACIA has longstanding partnership with Pratt & Whitney Canada and StandardAero. “We also work closely with some key partners on the MRO side to service our wider maintenance needs,” he adds.