Blue Origin’s successful launch of the New Glenn rocket could kick off a year of rocket debuts, initiating a period of global space economy growth.

“We are at an inflection point,” says Kelli Kedis Ogborn, vice president of Space Commerce and Entrepreneurship at the Space Foundation. While the industry for several years has talked about the space economy and its growth potential, “the pieces are really going to start to click,” he said.

More than 20 new launchers could achieve first flight this year. Rocket Factory Augsburg, for instance, received its vertical launch license from British authorities this month. Isar Aerospace and South Korean’s Innospace are among others looking to achieve the milestone.

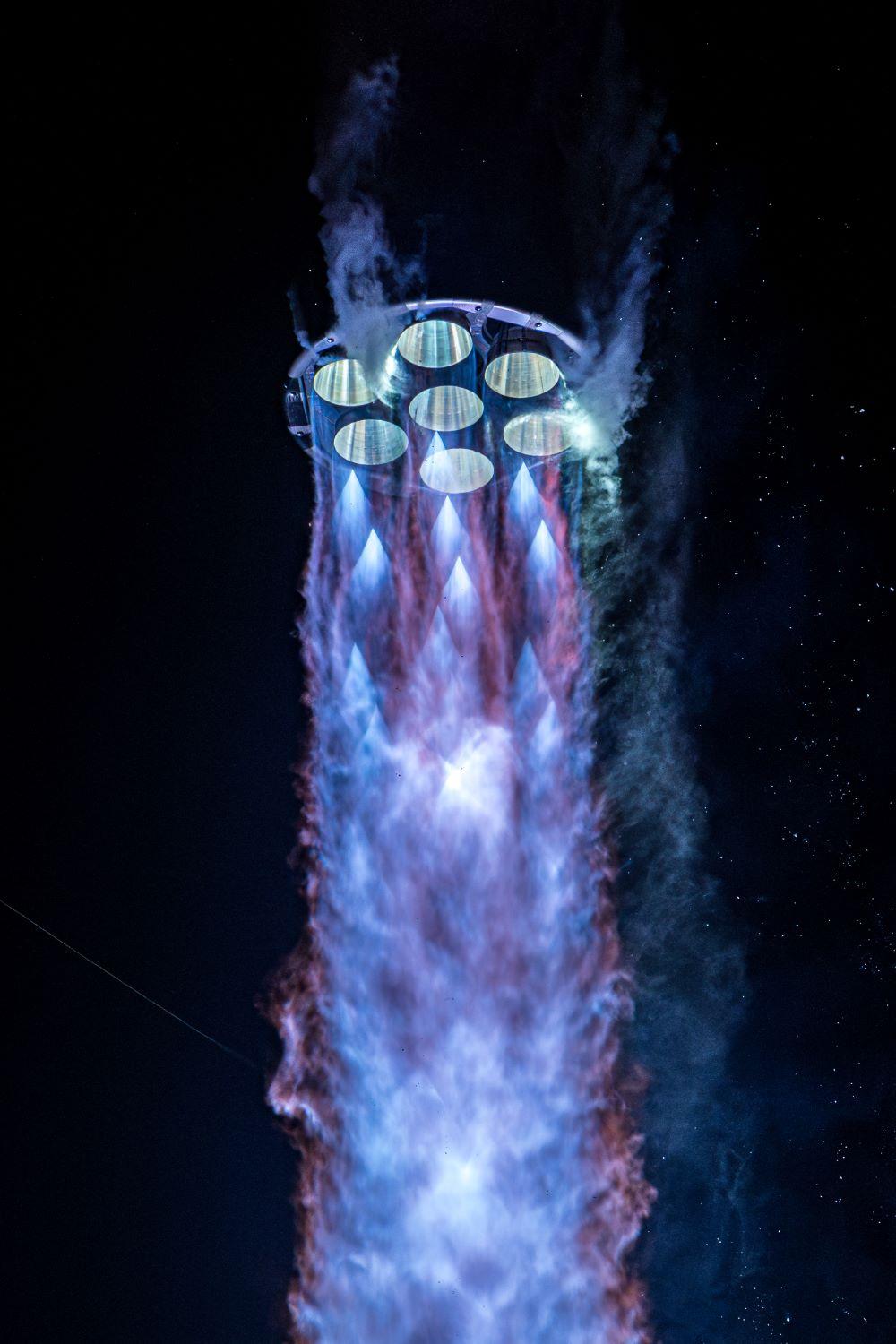

The recent growth in the space economy has largely been driven by SpaceX and its Falcon 9. The launch service provider has driven down launch costs and boosted the pace of flights, in part by demonstrating first-stage reuse. SpaceX on Jan. 22 landed a Falcon booster for the 400th time as part of a mission to deploy 27 of its Starlink satellites.

While other commercial launchers have become available, such as Rocket Lab’s Electron, the commercial launch market, particularly to fly multiple satellites, has still been somewhat constrained. New Glenn, with its 45-metric-ton payload capacity to low Earth orbit, and SpaceX’s Starship, once it has demonstrated payload deployment, promise to change the cost equation. SpaceX aims for another Starship test next month.

“I think we are going to see another step function change in terms of access to space,” Justin Cadman, co-CEO of consultancy Quilty Space, said on a recent Space Foundation webinar. “We are unconstraining the assets that we can put on orbit, which is just a game changer.”

Novaspace this month said it forecasts the global space economy to advance more than 50% in the coming years, reaching $944 billion by 2033 from $596 billion last year. Downstream applications will largely drive that revenue increase, the consultancy said.

It is not just launchers, though, that may underpin the space economy’s expansion. Space Capital, a seed-stage venture capital (VC) firm, expects lighter regulation during the Trump administration to fuel growth, in part because of the links to SpaceX CEO Elon Musk.

“Between Musk’s close ties with the incoming president, an administration that is expected to be strongly pro-growth and anti-regulation, and the emergence of Starship, we are on the verge of significant changes that will accelerate growth,” the VC firm said in its latest space investment report.