The global space economy showed strong momentum in 2019 but faces a significant challenge going forward due to the COVID-19 pandemic, the Space Foundation cautions in the first quarterly installment of its annual economic assessment.

Based in Colorado Springs, the nonprofit foundation indefinitely postponed its 36th annual Space Symposium, originally planned for this week, due to the novel coronavirus outbreak and continuing calls by medical experts for the public to observe social distancing until vaccines emerge.

Employment in the space industry continued a three-year rise in 2019, growing 4.1% over 2018 and reaching 141,520 jobs, the highest level in eight years, according to The Space Report 2020 Quarter One. The executive summary, released March 31, is part of a strategy by the foundation to market its formerly annual assessment in quarterly updates for the first time.

The U.S. workforce supporting the manufacturing of space vehicle propulsion units and other space vehicle components has grown by nearly 20% over the past five years, adding more than 14,000 new employees.

The COVID-19 pandemic is expected to drastically alter the trajectory of the overall 2020 economy, as reflected in recent stock market volatility. But the space sector is better insulated from market upheaval, according to industry experts around the country. Among them is Courtney Stadd, a civil and commercial space veteran and president of Capitol Alliance Solutions, LLC, a Maryland-based aerospace management consulting firm cited in the report.

“If COVID-19 rapidly diminishes in terms of threat over the next few months, the good news is that our industry’s fundamentals—access to low interest capital, available talent eager to return to work and a battered economy looking to rapidly recoup lost productivity—are such that we should be able to regain forward momentum by year’s end or first quarter 2021,” Stadd says.

Smaller startups are likely to be affected the most, warns Meagan Crawford, a SpaceFund managing partner.

“These companies could be drastically affected by delayed launches (resulting in a delay of revenue for the satellite companies), and by the inevitable slowdown in the investment sector as the private investors and venture capitalists the industry relies on are maintaining their liquidity in these uncertain times,” Crawford said. “Small startups and even medium-sized space companies will often have small cash reserves and may not be prepared for such disruptions.”

Some of the encouraging economic factors cited in the report’s Quarter One version include a count of 102 nations that own all or a portion of a satellite or ground station, or claim a satellite launch—slightly more than half the world’s nations as recognized by the United Nations.

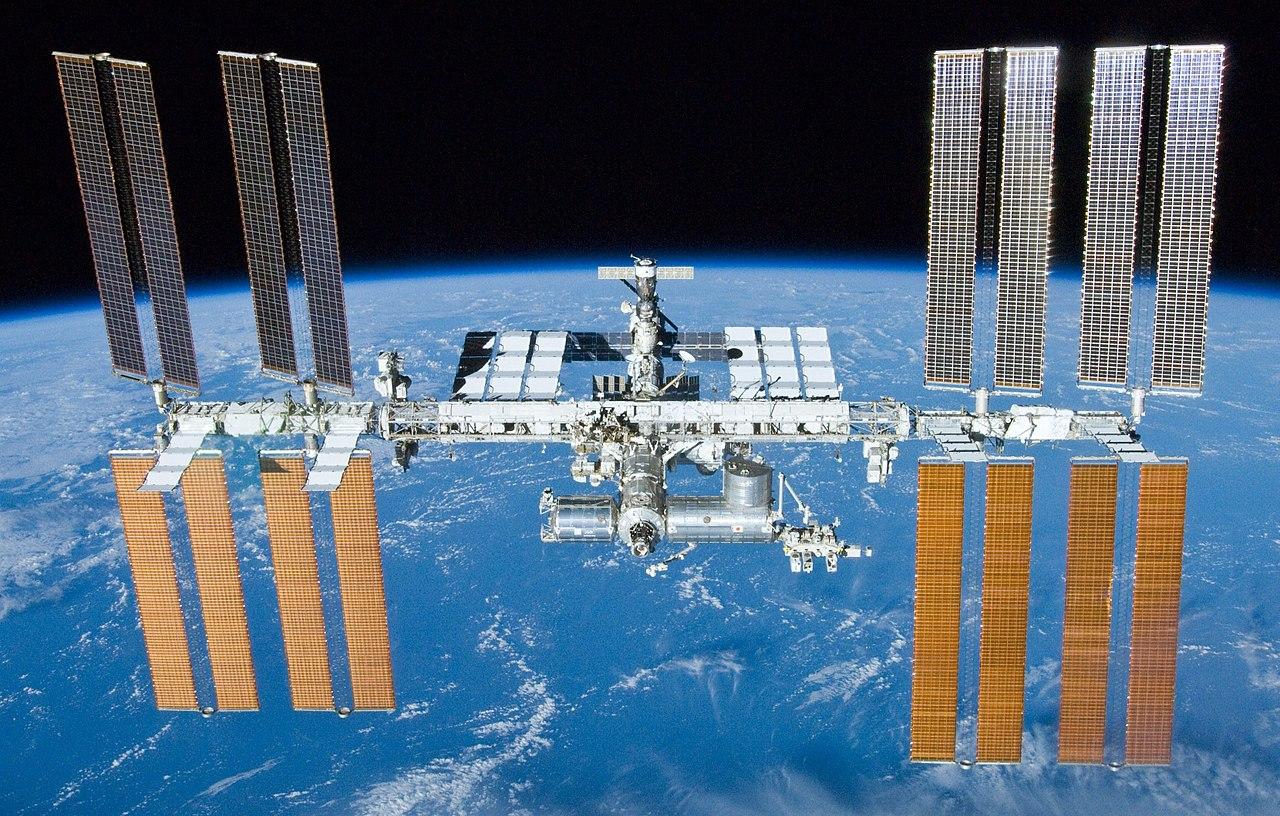

The summary also points to the 15-nation, U.S.-led International Space Station (ISS) as a catalyst for growing scientific research and technology development sparking investor interest in fields ranging from biotechnology and pharmaceuticals to 3D manufacturing. The time spent by ISS astronauts on those activities reached 967 hr. in 2019, an all-time high and 27% more than 2018.

The ISS National Lab investor census reached 157 in 2019, a 33% increase over 2018. Together the investor pool manages an estimated $420 billion in total assets. A majority of the National Lab’s non-NASA funding—$87 million, or 57% of the total—came from the commercial sector last year. Between 2015 and 2019, commercial funding grew by 195%.

Meanwhile, annual worldwide launch attempts rose by 39% over the past decade, reaching 103 by seven different nations in 2019, or an average of two per week. The flights involved 44 launch vehicles and achieved an overall success rate of 94.2%. China, followed by the U.S., Russia, the European Space Agency, India, Iran and Japan led the launch activities, the second highest level in a decade.

U.S. rockets launched just less than half of all the payloads deployed into orbit, 3 1/2 times that of second-place China.

Separately from the Space Foundation’s report, Morgan Stanley in July 2019 estimated the global space economy at “roughly $350 billion,” due to government as well as private sector spending and prepared to surge to more than $1 trillion by 2040.