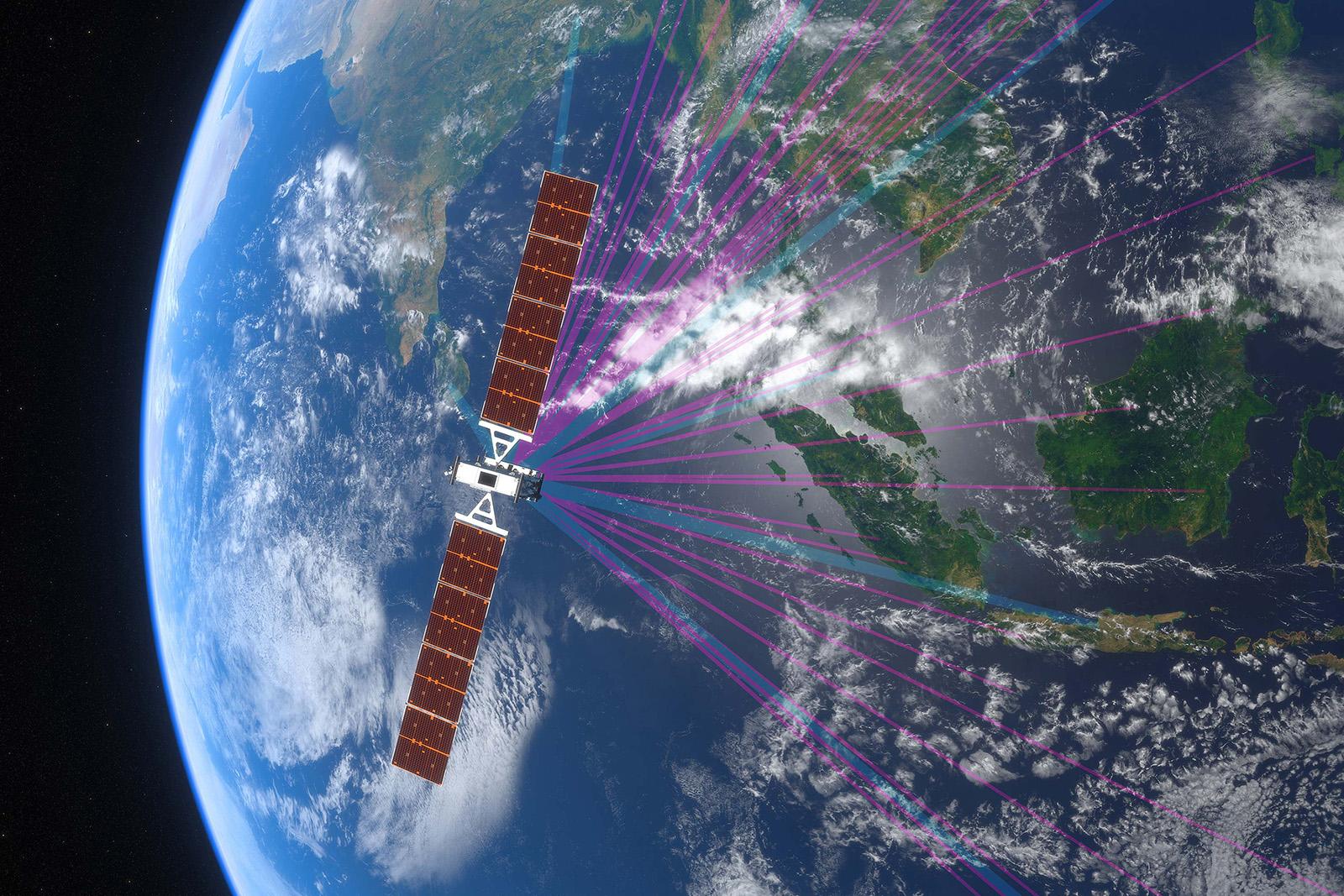

Communications satellites are increasingly competitive with terrestrial telecomms due to lower launch costs.

COLORADO SPRINGS—Consultancy McKinsey sees the global space industry growing to an estimated $1.8 trillion by 2035, up from $630 billion in 2023.

The report by McKinsey and the World Economic Forum anticipates the industry will grow at an average of 9% per year, outpacing global GDP growth. This will be driven by space-based or space-enabled technologies such as communications, positioning, navigation and timing, and Earth-observation satellites.

More than 60% of the growth will be generated by five industries: supply chain and transportation; food and beverage; defense; retail, consumer goods and lifestyle; and digital communications, according to the consultancy’s projections.

Lower launch costs—driven by SpaceX’s partially reusable Falcon 9 launch vehicle—as well as the adoption of commercial electronics are driving down the cost of building, launching and operating satellites in space, according to Ryan Brukardt, senior partner with McKinsey. “We see a number of use cases that historically didn’t close using a space-type asset now beginning to close because of reduced costs,” he said at the Space Symposium here.

For example, Iridium, Globalstar and Teledesic went bankrupt in the late 1990s and early 2000s in competition with terrestrial communications providers that had a glut of lower-cost fiber-optic cable networks. This time is different because lower costs now allow communications satellites to compete with terrestrial businesses, Brukardt says.

Increased military demand for spacecraft also will boost demand and provide a tailwind for the sector, according to the report. However, whereas the space industry was heavily skewed toward military applications in the past, now the sector is diversifying rapidly by integrating into technologies that are part of people’s everyday lives, such as ride-hailing, weather services, parcel tracking and food delivery.