China

In mid-fall 2021, Pratt & Whitney inducted the first geared turbofan in China at MTU Maintenance Zhuhai, a joint venture between MTU Aero Engines and China Southern Airlines. The joint venture joined Pratt’s GTF network in December 2020 and has begun constructing a second engine facility that will overhaul both GTFs and V2500s. The second facility is expected to start operations in 2024 and to handle 260 shop visits annually, with a staff of 600. A training center for up to 150 students per year should open in Zhuhai by 2023.

China

In line with its latest five-year plan, Ameco is building a new workshop for airframe-related components, and in 2022 it will add a new hangar at Chengdu Tianfu International Airport and a business-jet interior workshop. In 2022 it will also begin constructing hangars at Beijing Daxing, Hangzhou and Wuhan airports. Next year the large Chinese MRO also plans to build overhaul capability for both Pratt & Whitney’s GTF engines and Honeywell’s HGT1700 auxiliary power unit. The five-year plan calls for modifying Airbus aircraft for cargo duties.

Asia-Pacific

In the Asia-Pacific region, SIA Engineering Co. (SIAEC) continues to invest in new capabilities. SIAEC signed a memorandum of understanding in March to acquire part or all of SR Technics Malaysia, and it has established a new engine services division, initially focused on the CFM Leap engine. The MRO’s base maintenance ventures, SIA Engineering Philippines and Heavy Maintenance Singapore Services, became wholly owned subsidiaries in 2020. SIAEC plans investments of S$40 million ($29.2 million) over the next three years, deepening digitalization and automation, including a SMART MX mobile app and an engine-lifter for engine changes.

Asia-Pacific

Lion Air Group subsidiary Batam Aero Technic (BAT) says it will add six heavy maintenance lines by the end of 2021, bringing its total capacity at Batam Hang Nadim Airport to 21 lines. BAT would like to eventually double its capacity to 50 lines in an airport designated by the Indonesian government as a special economic zone. Lion Air had the biggest share of Indonesia’s 100 million pre-COVID-19 domestic passengers. During the pandemic, BAT increased digitalization and reduced costs. BAT holds FAA approval for Boeing 737NGs and hopes to attain European Union Aviation Safety Agency (EASA) approval for the Airbus A320 family in 2022 or 2023. The Batam economic zone expects investments of up to $440 million in MRO by 2030.

Asia-Pacific

In Taiwan, GE Evergreen Engine Services, a joint venture between Evergreen Aviation Technology and GE Aviation, has announced the opening of a new component repair site at Guanyin Industrial Park. Many of these repairs have been performed at an existing overhaul site at Taiwan’s Taoyuan International Airport, but some engine components have been sent to various locations outside of Taiwan for repair during engine overhauls due to capacity constraints. The MRO now plans to keep most repairs in Taiwan at the new location, which is 16 km (10 mi.) from the airport.

The new facility, which has three floors and more than 13,000 m2 (140,000 ft.2) of space, will allow more capacity to grow overhaul and repair operations. It will also reduce shipping costs and could help improve turnaround time for engine overhauls and parts repairs. More than 500 employees work at the two sites, with more than 100 having moved to the new facility. More hiring at the new site is planned for 2022.

Asia-Pacific Region

AAR Indamer Technics, a joint venture between Indamer Aviation and AAR, announced in August 2021 the opening of its Nagpur facility, which will provide maintenance to aircraft from India and nearby countries. It is now ready for the Airbus 320 family and will soon be ready for Boeing 737s. Various shop capabilities have been developed to support heavy checks, including structural repairs, non-destructive testing, and cabin and seat repairs.

The MRO is approved by India’s Directorate General of Civil Aviation, and it has filed for approval by EASA and the FAA. The staff currently comprises 120 employees. The facility is built on 30 acres in the MIHAN Special Economic Zone in Nagpur, Maharashtra. It houses several hangars for heavy checks, including a dedicated hangar for aircraft painting. Electricity is sourced through rooftop solar panels. Water needs are met through ground- and rainwater harvesting, while on-site effluent and sewage treatment plants treat wastewater to be reused in horticulture areas.

AAR Indamer has already welcomed IndiGo, India’s largest airline, as its first client.

Middle East

In The Middle East, Joramco continues to expand services well beyond the heavy checks it is known for. In October 2021 it signed a cooperation agreement with UUDS AERO of France to expand its capabilities for cabin refurbishments and Boeing 737-800 passenger-to-cargo conversions. That same month, Joramco also signed a memorandum of understanding with Testia to cooperate in establishing a fluid testing laboratory to perform particle-count testing of hydraulic fluids and perhaps eventually test fuel, engine oil and water.

Middle East

Lufthansa Technik Middle East signed a partnership agreement with Sanad in November 2021 to develop technology solutions to digitize maintenance. The Dubai-based MRO also signed a memorandum of understanding with Joramco in June 2021 to partner on nacelle MRO, and last year it signed a cooperation agreement with GMR Aero Technic in India.

Africa

Israel Aerospace Industries (IAI) will establish a passenger-to-freighter conversion site at Ethiopian Airlines’ maintenance facilities in Addis Ababa for Boeing 767-300s. It will initially convert three Ethiopian 767-300s, then expand its services to other airlines in Africa and the wider region. Ethiopian has a large MRO presence in its country’s capital, where it offers aircraft maintenance and overhaul, staff training and guidance, as well as assistance in acquiring certification and licenses. The move into Africa further expands IAI’s global footprint, which will include Tel Aviv, Mexico City and Lithuania.

Europe

In Europe, FEAM plans to expand its overseas footprint with its recent acquisition of BOSA, which has repair stations near Manchester, UK and at Flughafen Leipzig/Halle, Germany. The MRO and staffing company plans to add upwards of 450 mechanics throughout its network over the next year, and it is also adding new technology tools, such as mixed-reality goggles for remote assistance and collaboration.

FEAM has also opened three new U.S. line stations in Columbia, South Carolina; Spokane, Washington and Philadelphia, and it plans to develop avionics modifications and installation capabilities at its Miami base maintenance facility.

Europe

Nayak Aircraft Services, which performs line maintenance at more than 60 airports throughout Europe, has expanded its Barcelona activities by creating Yellow Technic, a Part 145 joint venture with Vueling Airlines. Through this partnership, Nayak provides maintenance at Vueling’s home base for Airbus A320s and Vueling obtains full insight into and influence on decision-making in maintenance procedures.

In 2022, Nayak plans expansions of line maintenance at many Spanish airports such as Alicante, Malaga, Seville, Bilbao, Zaragoza and Palma de Mallorca. Another location in Europe that will soon be supported by Nayak is Gdansk in Poland. Current recruitment is underway so Nayak can be up and running at Gdansk in April 2022.

Europe

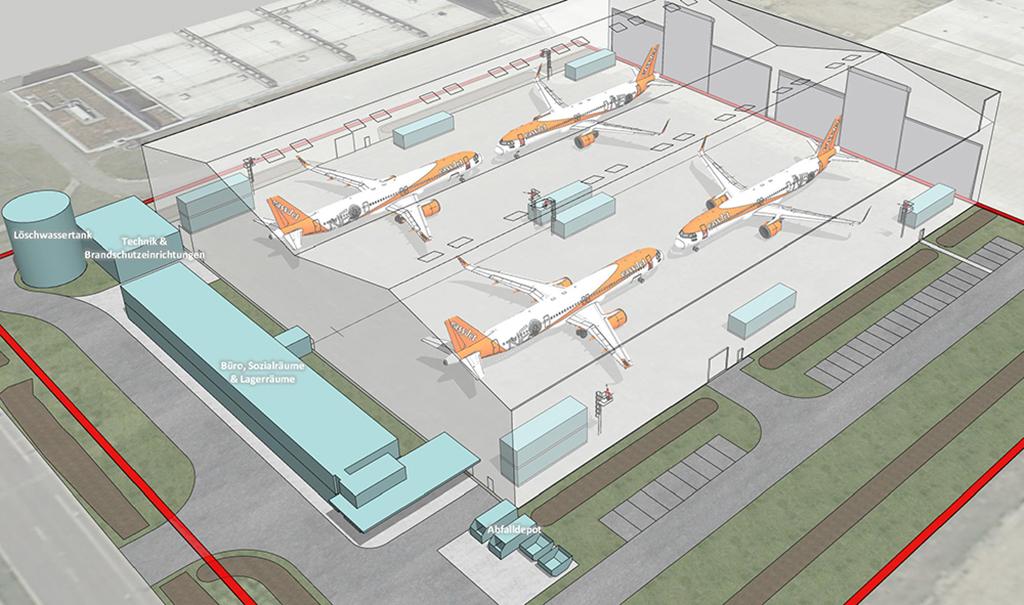

EasyJet is building a new maintenance hangar at Berlin Brandenburg Airport, which is planned to be fully operational at the start of 2023. The carrier will invest €20 million in the new hangar and existing Brandenburg facilities. This will be the airline’s first maintenance hangar outside the UK. The 10,000-m2 (108,000-ft.2) hangar will accommodate four narrowbodies up to the size of an Airbus A321 and will be used for light base maintenance. The new hangar will support easyJet’s European fleet of about 120 A320-family aircraft operating under an Austrian air operator certificate.

Europe

Danish MRO Northern Aerotech (NAT) began providing line maintenance to Switzerland’s Chair Airlines in 2021 at Zurich Airport, where it also supports Condor, Enter Air, Aegean Airlines, Air Malta and Ukraine International Airlines. NAT is now looking to acquire a hangar for base maintenance on narrowbodies somewhere in Europe and also is seeking an EASA certificate for widebody maintenance.

Europe

STS Aviation Services continues to grow and build new capabilities for legacy and next-generation aircraft at both of its base maintenance facilities in Newquay and Birmingham, UK. STS CEO Mick Adams says the company has increased its headcount from 25 to nearly 200 full-time employees in the UK. The MRO plans to have Part 21J design approval in 2022 and will soon have battery overhaul capability. STS Aviation Services plans to grow its capacity again in 2022, with a focus on systems and processes.

Europe

After acquiring the maintenance arm of Flybe, Dublin Aerospace established a UK MRO, Exeter Aerospace, to perform base maintenance on Embraer 170s and 190s, De Havilland Canada DHC-8-400s and ATR 72s. All six bays have been occupied, and Exeter turned its first profit in May 2021. In October 2021, Dublin Aerospace opened a landing gear overhaul facility that specializes in Airbus A320 and Boeing 737 landing gear overhauls. Spread across 70,000 ft.2 and located 15 mi. northwest of Dublin, the facility will be able to overhaul up to 350 gears per year with its 150 employees.