MRO Europe 1999: PMA And The 'Industry Mega-Trend'

LIMERICK, IRELAND—GE apparently has settled on the carrot-and-stick approach to dissuade airlines from using PMA parts.

Speaking at Aviation Week’s MRO William Vareschi offered airlines spare part cost guarantees in return for carriers limiting PMA part usage.

“Given a commitment from you, we are prepared to move away from the annual rite of fall, the spare parts price discussion, which some of you have labeled as arbitrary and out of sync with reality, and move toward long-term material cost guarantees for you; cost guarantees that provide you more predictable cost over the life cycle of your engines; and working with you to ensure that these costs are equal to or lower than inflation,” he said.

In the same speech, however, Vareschi warned airlines that they face losing OEM support of GE and CFM engines should PMA part usage proliferate.

Vareschi said the OEM is “keenly aware” of the spare parts airlines are putting into their engines and that it “understands the ongoing expansion of alternatives available to you, from nuts, bolts and brackets to flight and safety-critical parts.”

Vareschi questioned the safety of PMA parts and whether the companies that make them have the ability to provide service and support levels comparable to the OEMs. “This is critical because OEMs simply will not be able to provide the same level of support that you have grown accustomed to given this new environment,” he said.

About 8% of the parts on a CFM56-3 engine have PMA alternatives, and that could increase to as much as 25-30% if PMA vendors are successful in moving on compressor blades and HPT (high- pressure turbine) blades, Vareschi said. “That’s an area where we’re interested in keeping [PMA parts] out of our engines . . . and at which point in time our systems responsibility now has to be turned over to the PMA,” he said.

When asked just when the OEM would tell an airline it could no longer support an engine, Vareschi said, “When they [PMAs] start getting into flight and safety-critical parts, that’s when we have to divorce our corporate responsibility. . . . It’s a liability [issue] and an economic issue.”

GE and other players within the industry face some very difficult questions about PMA parts, Vareschi said. “First, how do we compete with companies that take little or no technical or financial risk and simply copy our parts? Second, faced with more competition for spare parts, can the engine OEMs continue to do business the old way: Invest billions of dollars up front; lose money on the sale of new engines and then hope to make the program profitable by selling spare parts for the next 20 years? And finally, can the engine OEMs continue to invest in the cost-of-ownership [reduction] technology that have brought about productivity benefits?”

He also said the OEM is “concerned about the potential negative impact PMA parts may have on GE engines. “We cannot predict how these different parts will interact in a complex engine system.”

Vareschi admitted that piece-part prices will continue to fall as competition between OEMs and PMA vendors increases, but he questioned whether the lowest piece-part price equates to the lowest life-cycle cost.

In addition to the material cost guarantees, Vareschi said GE is committed to helping its airline customers lower the cost of engine ownership in a number of ways, including upgrading mature engines with new technology. This year, GE introduced the new HT90 turbine blade on the “very old” CF6-6. Vareschi said the move will improve on-wing time by over 50% and significantly reduce blade scrap rates. The company is working on similar programs for the CF6-50 and the CFM56-3.

Other efforts include developing new component repairs, some involving coating rejuvenation, to extend the useful life of parts, and indirect cost-reduction initiatives including inventory management programs, spare engine support, buying back spare engines, and expendables discount programs.

Of course, airlines and maintenance providers have a different take on PMA parts, which, as Vareschi pointed out, are often cheaper than OEM-made spares.

During a subsequent session at the conference, when asked about PMA parts usage, Karl-Rudolf Rupprecht, vice president of marketing & sales for Lufthansa Technik, pointed out that the parts are certified and approved for use by the regulatory authorities. He also said the PMA parts sometimes provide better performance than OEM-made spares.

Full-Service Support

A recurring topic throughout the conference, which drew more than 75 exhibitors and 1,100 attendees, was the trend toward full-service support. Rupprecht described it as “an industry mega-trend” and said that the “vast majority” of start-ups as well as some of Europe’s dominant flag carriers, such as Lufthansa, British Airways and Air France, are buying full-service support.

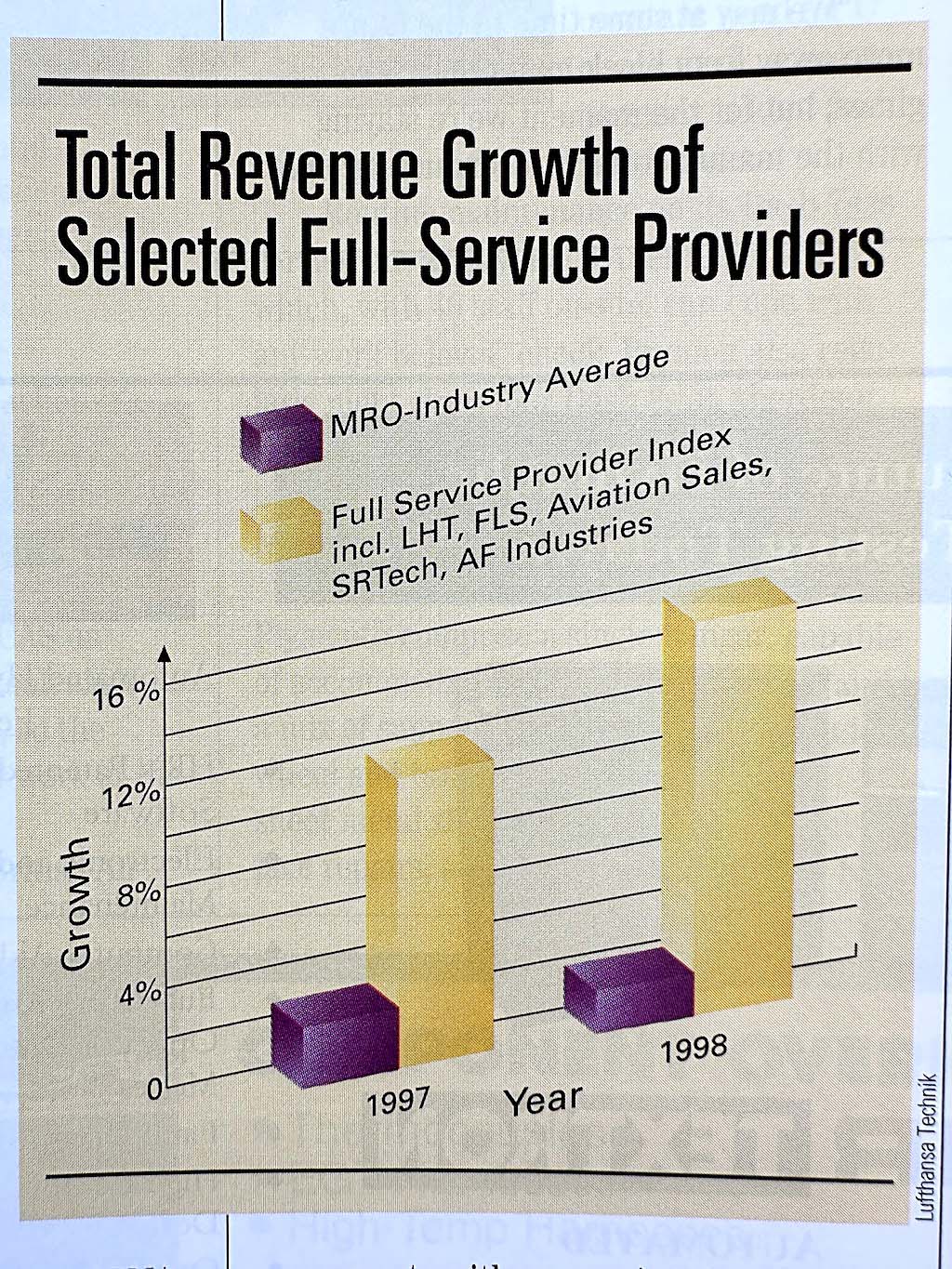

According to statistics generated by Lufthansa Technik (LHT), the revenue of full-service providers, including LHT, FLS Aerospace, Aviation Sales, SR Technics and Air France Industries, grew significantly faster in 1997 (nearly 12%) and 1998 (more than 15%) than the MRO industry average in the same two years (roughly 2%). LHT posted a profit of $68 million on revenue of $1.8 billion in 1998.

In outlining the potential benefits to airlines who contract for full-service support, Rupprecht said that it is important for the service providers to have airlines experience. He said only an operator knows how to get aircraft back in the air on short notice and that airline shops are better able to cope with unexpected technical failures. Also, because up to 60% of all MRO costs derive from OEM materials, a supplier needs airline experience and buying power to negotiate the best prices, he said.

In outlining the potential benefits to airlines who contract for full-service support, Rupprecht said that it is important for the service providers to have airlines experience. He said only an operator knows how to get aircraft back in the air on short notice and that airline shops are better able to cope with unexpected technical failures. Also, because up to 60% of all MRO costs derive from OEM materials, a supplier needs airline experience and buying power to negotiate the best prices, he said.

Harry Gregory, vice president and general manager of Collins Aviation Services, the customer support arm of avionics and inflight entertainment OEM Rockwell Collins, said the primary forces reshaping the aviation industry are the increased cost of airline maintenance, increased regulatory oversight and the growth in product reliability, which results in smaller volumes and higher repair costs per unit. He said airlines should turn to the OEMs for full-service support because of the manufacturers’ in-depth product knowledge; because services can be bundled in with the sale of new products; and to avoid having to make the capital investments required to maintain products.

Gregory, Rupprecht and Alain Bassil, CEO of Air France Industries, all stressed the breadth of MRO services being offered. Bassil said there is a growing demand for service integration from spares and repairs to financing.

But Ray Webster, managing director of UK-based low-fare carrier easyJet, said airlines are looking for more than just a menu of services. Rather, what airlines need are support programs tailored to their specific needs.

“We weren’t getting what we needed from our previous maintenance supplier,” Webster said. “They weren’t prepared to customize to meet our needs. Prescribed solutions are not what we wanted.”

What EasyJet wanted was the equivalent of in-house maintenance capability without the downside of investment. So easyJet struck a deal with FLS Aerospace, and it has outsourced all of its maintenance to a joint venture, easyTech, that it set up with FLS. The venture is owned 75% by FLS and 25% by EasyJet.