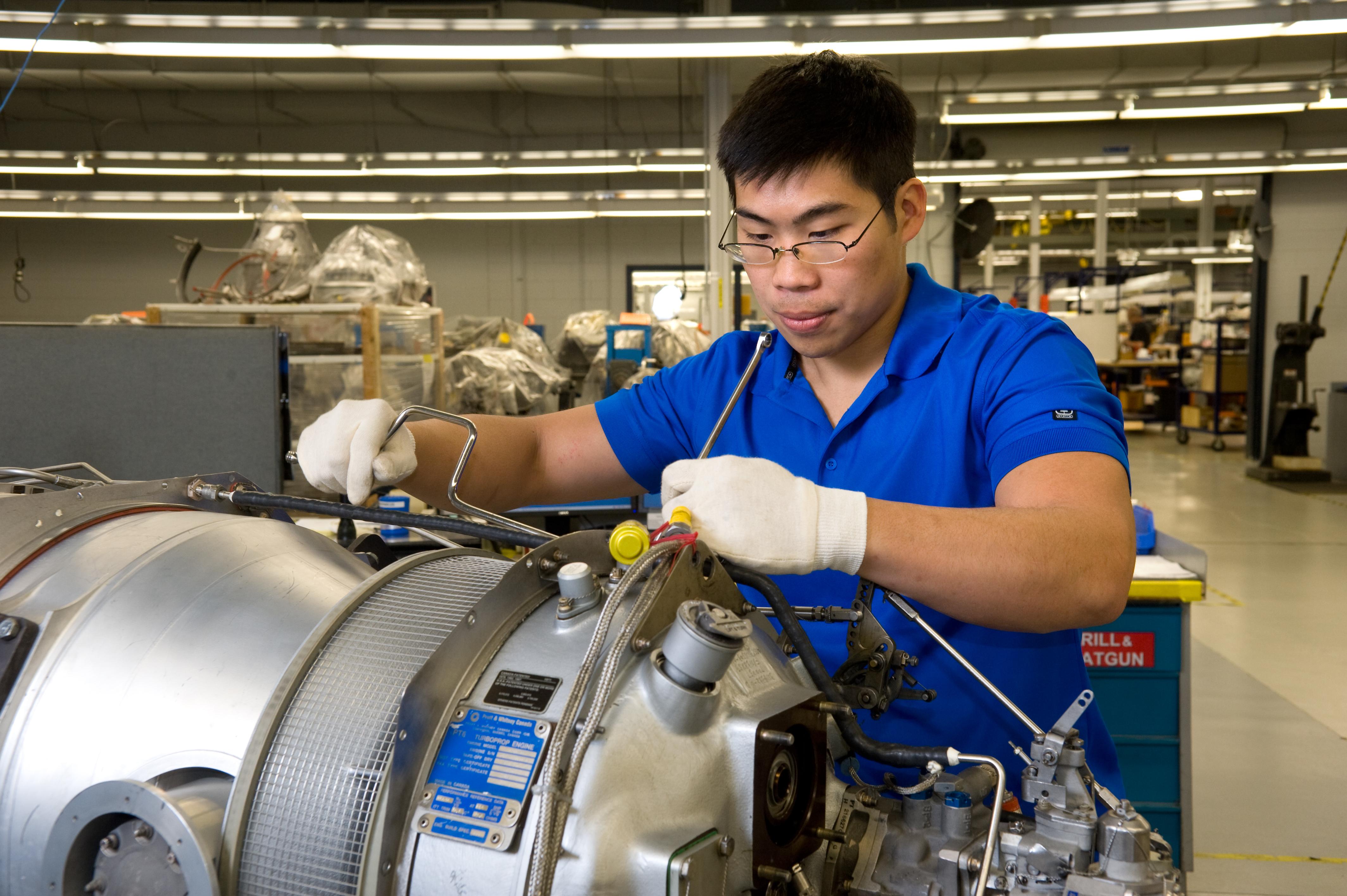

Recovery in the regional aircraft market is driving engine MRO demand at StandardAero, which has secured a slew of recent contracts to service engines powering turboprop airframes.

On May 10, Spanish regional airline Air Nostrum selected StandardAero to provide support services for the Pratt & Whitney PW127M engines powering its fleet of ATR 72-600 regional turboprops. The exclusive five-year contract will see StandardAero providing the airline with hot section inspections and additional services from its OEM-authorized PW100 Designated Overhaul Facilities in Gonesse, France and Summerside, Canada. Air Nostrum also renewed contracts with StandardAero for support of Honeywell APUs equipping its fleet of Bombardier CRJ200 and CRJ900/1000 regional jets, which the MRO provider will service from its Maryville, Tennessee facility.

Earlier in May, Air Seychelles awarded StandardAero a multi-year contract to support the Pratt & Whitney PT6A-34 turboprop engines powering its fleet of De Havilland Canada DHC-6 Twin Otter aircraft. StandardAero will provide the airline with a range of MRO services from its OEM-authorized PT6A Designated Overhaul Facility in Johannesburg, South Africa, which supports 41 variants of the engine type up to and including the PT6A-140.

In late April, Russian airline Utair selected StandardAero to provide overhaul support for the PW127M engines powering its fleet of ATR 72-500s. As with the Air Nostrum contract, StandardAero will provide support from Gonesse and Summerside.

According to Lewis Prebble, StandardAero’s president of airlines and fleets, MRO demand for most regional aircraft engines has fared better than it has for large fans during the pandemic due to the higher impact on the long-haul market. “The gradual recovery in demand has varied from region to region and from product to product, and several key regional markets are still battling serious COVID-19 outbreaks, but the overall level of customer confidence currently seen in the marketplace is certainly encouraging,” says Prebble.

“The regional and short-haul markets have traditionally driven the majority of demand for the engine services that we offer, and we have therefore been relatively protected from the pandemic’s impact on long-haul demand,” he says, adding that demand from military customers remained stable throughout 2020 and the proportion of revenues from this segment increased slightly during the year. “Likewise, the strength of the cargo market over the past year has also grown its share of our revenues across all relevant product lines, from the PT6A and PW100 to the CFM56-7B and RB211-535.”

As work picks up, Prebble says StandardAero is continuing to carefully manage its capacity to meet the gradual recovery in demand. “While we of course hope to return to pre-COVID levels of output and employment as soon as possible, we are striving to increase capacity in a way that maximizes operational efficiency, in order to minimize costs and turnaround times for our customers,” he says. “Our CFM56/CF34 facility in Winnipeg has already undertaken several employee recalls over recent months, and we are hoping that current market trends continue in the right direction as the vaccination rollout rebuilds traveler confidence.”

According to Prebble, StandardAero will be sharing “a large number” of additional global contract announcements in the near future covering platforms such as the CF34, PW100, PT6A and JT15D.