The sudden but short-lived travel ban that President Donald Trump imposed on nationals from seven mainly Muslim countries entering the USA appears to be deterring travellers from other countries around the world too, according to analysis by intelligence provider ForwardKeys. The Valencia-based company’s analysis has discovered a 6.5 per cent negative variation in bookings compared with the equivalent eight-day period the year before.

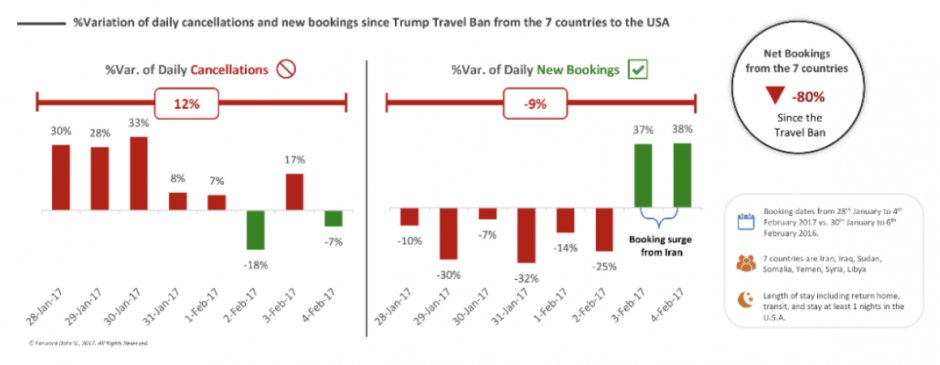

Unsurprisingly, the findings show that after Mr Trump’s initial travel ban (imposed on January 27, 2017) net bookings issued from those seven countries (Iraq, Syria, Iran, Libya, Somalia, Sudan and Yemen) between January 28, 2017 and February 4, 2017 were down 80 per cent on the same period last year. But this trend has spread across the world with bookings into the United States of America (USA) falling from all parts of the world.

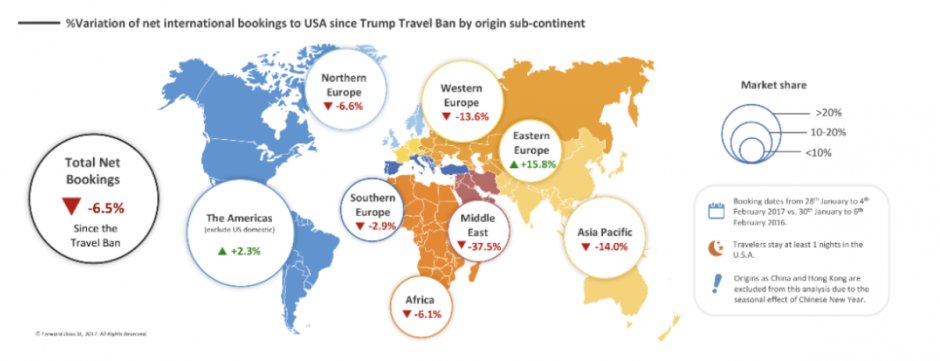

This suggests the turmoil over the ruling is putting off people travelling to the US from many regions of the world, beyond just the Middle East. According to ForwardKeys, travel from the Middle East was down 37.5 per cent and from Asia Pacific down 14 per cent. Breaking up European trends, bookings from Northern Europe were down 6.6 per cent, from Western Europe were down 13.6 per cent and from Southern Europe down 2.9 per cent.

In every case, the USA has lost market share as total outbound travel from Northern Europe was flat, from Western Europe was down 1 per cent, from Southern Europe was up 3.1 per cent, form the Middle East was down 13 per cent and from Asia Pacific was down 8.9 per cent, highlighted the ForwardKeys analysis.

Against this trend, bookings from Central/Eastern Europe and The Americas were up 15.8 per cent and 2.3 per cent respectively during the period. However, when one looks again at outbound travel from those two regions of the world, total travel was up substantially, 12 per cent from Central/Eastern Europe and 4.8 per cent from the Americas so the increases in travel to the USA are not so impressive.

For the Middle East as a whole – beyond the banned countries – during the last year, the data shows bookings to the USA were already down 8.8 per cent, but fell to almost -38 per cent in the January 28, 2017 to February 4, 2017 window. At the top of the reductions was Saudi Arabia were bookings were down 60 per cent although external factors such as the timing of a school break across the analysis window would have skewed the data.

“Whilst travel bookings on any given day can be significantly up or down compared to the same day a year before, variability over a few consecutive days is typically much less,” noted ForwardKeys. “The eight-day period coinciding with the travel ban is the first time since before the presidential election in early November that there has been a consistently long run of negative variations compared with the equivalent period the year before. For reference, inbound bookings to the USA for the whole of the past year were only down 0.4 per cent.”

After Federal Judge James Robart placed a temporary block on Donald Trump’s travel ban, bookings to the USA from Iran, on February 3, 2017 and February 4, 2017 saw a dramatic surge, five times higher than same two days last year. Most were for arrival on February 5, 2017 and February 6, 2017 and with lengths of stay of 22 nights or more, noted the ForwardKeys analysis. “Iran was the only country to see such a surge following the suspension of the ban,” it said.

As ForwardKeys only monitors the true origin of trips, not the nationality of travelers, the figures in its analysis for travel from places like Iran could also include expats living there and returning home. Also, there are nationals of the seven banned countries living elsewhere who were prevented from travelling to the USA on flights originating in other countries.

Routes Americas 2017

Latest developments across the Americas will be discussed by high-level speakers at Routes Americas 2017, the region's foremost route development event, taking place in Las Vegas on 14-16 February.

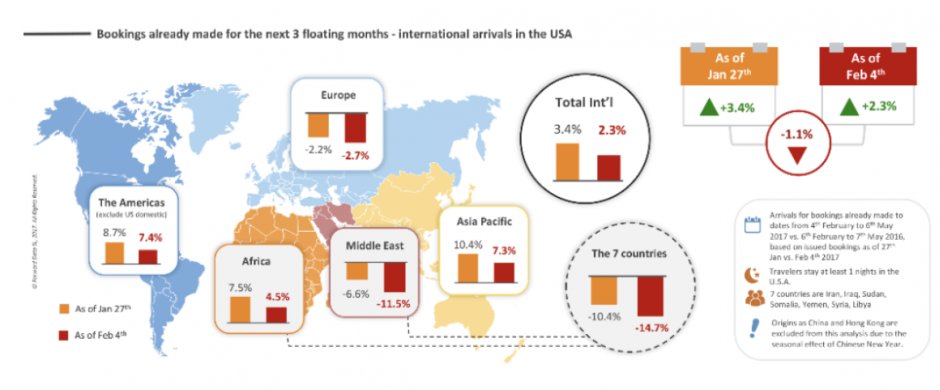

Taking a look ahead at bookings for future US arrivals over the next three months, the seven banned countries are behind 15 per cent on last year, according to ForwardKeys. However, on January 27, 2017 they were already tracking 10 per cent behind. “This illustrates how the travel ban worsened an already negative trend,” said the intelligence specialist. Total international bookings for US arrivals for the coming three months are currently 2.3 per cent ahead of last year. However, just eight days before, they were running 3.4 per cent ahead and have also seemingly been impacted by the travel ban.

“The data forces a compelling conclusion that Donald Trump’s travel ban immediately caused a significant drop in bookings to the USA and an immediate impact on future travel,” said Olivier Jager, chief executive officer, ForwardKeys. “As inbound travel is an export industry (it earns foreign currency), this is not good news for the US economy.”

USA has "huge economic interest" in Norwegian's long-haul low-cost plans

Meanwhile, it appears that the Trump administration is backing the plans of Norwegian to establish bases in the US. The airline's application for a foreign operating permit was approved by the Obama administration late last year after numerous delays in the process and it appears that the airline's plans to launch long-haul flights from both the Boston and New York area markets has the approval of the new president.

Speaking this week, White House press secretary and Trump's communications director, Sean Spicer said: "In the case of Norwegian, my understanding if I'm correct is there is a deal which they're having 50 per cent of the crews and the pilots are American based, they're flying Boeing planes.

"There's a huge economic interest that America has in that deal right now. I don't want to get ahead of the President on that but just to be clear, you're talking about US jobs both in terms of the people who are serving those planes and the person who's building those planes."

However, he suggested it may not be the same outlook for the Gulf carriers and the long-running dispute between the US majors over illegal state subsidies to these operators that is fuelling their growth in the US market. "That's a very big difference," said Spicer in comparing that topic with the Norwegian plan.

He suggested that is a likely topic when Trump meets with airline leaders this week. "That will be something - that will be decided when they meet, what they talk about. The President's obviously going to want to talk about economic growth and job creation, how he's enacting orders to make sure the country's safe," he added.